Why Facebook Ads Payment Failed? Here's How To Fix It [2025]

Experiencing payment failures on your Facebook Ads account can be frustrating and disrupt your marketing efforts. There are several common reasons for these failures, such as insufficient funds, expired credit cards, technical issues, and account suspensions. Understanding these causes and knowing how to fix them can help keep your ad campaigns running smoothly. In this article, I’ll explain why Facebook Ads payments failed and offer simple solutions to solve these problems.

Common Reasons Why Payment Failed in Facebook Ads?

It’s important to know why ad payments might fail. Problems like technical issues or not enough funds can stop your Facebook Ads. Understanding these reasons will help you keep your ads running smoothly and successfully.

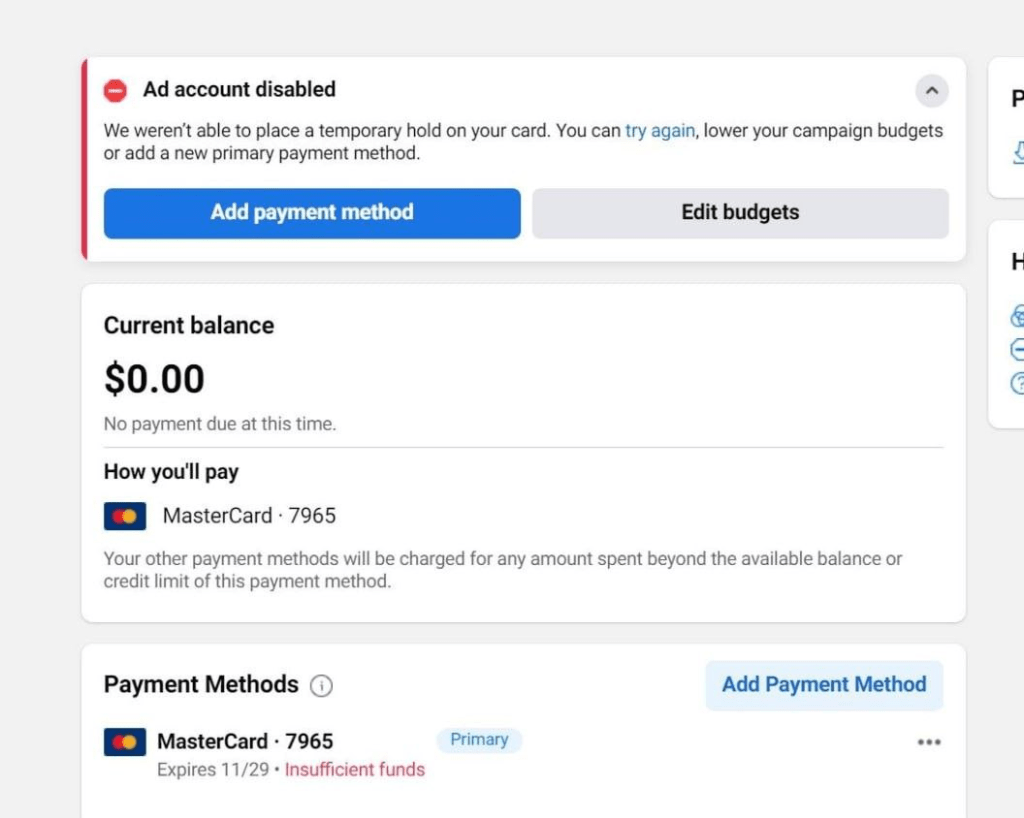

#1 Insufficient Funds

A common reason for Facebook Ads payment failure is not having enough funds in your account. If your payment method lacks the necessary balance to cover the ad costs, Facebook won’t be able to process the payment. Make sure your payment method has sufficient funds before starting an ad campaign.

#2 Expired Credit Card

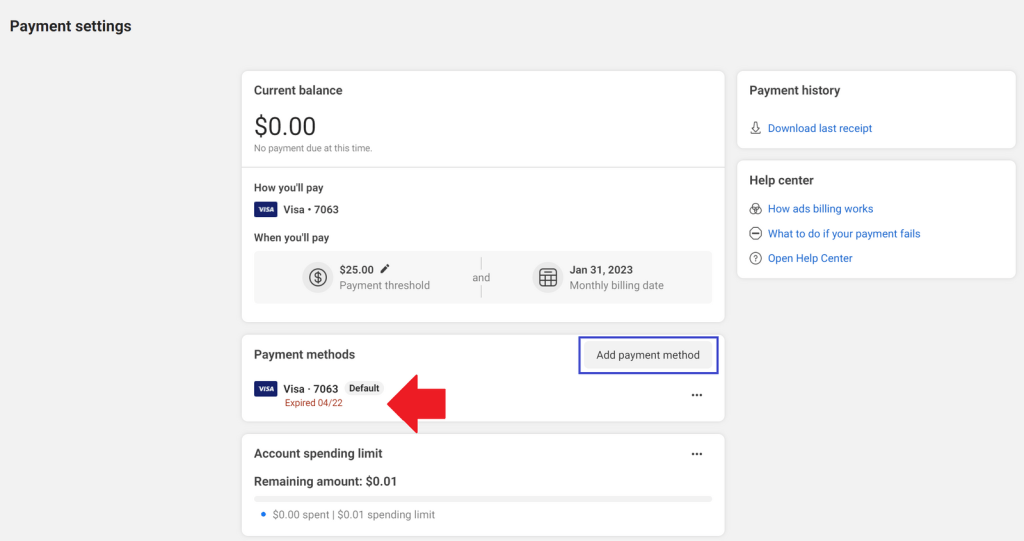

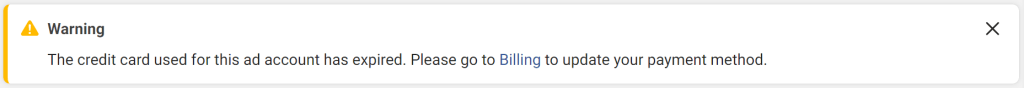

An expired credit card is another common cause of payment failure. If the credit card linked to your Facebook Ads account has expired, Facebook won’t be able to charge it. To fix this, update your payment method with a valid credit card.

#3 Rejected by Banks or Payment Service Providers

One primary reason for a Facebook Ads payment failed is the complex interaction between the ad platform and banks or payment service providers. If the payment information provided doesn’t match the required criteria or appears suspicious due to discrepancies, banks or payment providers might decline the transaction to prevent potential fraud or identity theft. This can occur if you input inaccurate information or if the billing address used doesn’t align with the records held by your bank or payment provider.

For example, some local digital banks may reject Facebook Ads payments because they have restrictions on cross-border transactions or services they consider less secure.

To avoid payment rejections, advertisers should understand the policies and requirements of their banks or payment service providers. Using a reputable payment card like Aspire, which is linked to the MasterCard network, can help ensure your Facebook Ads payments go through. Additionally, talking directly with your bank or payment provider to make sure they recognize your transactions can prevent unnecessary rejections.

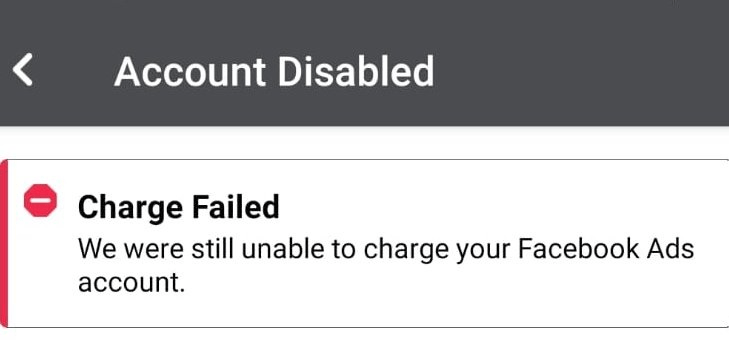

#4 Facebook Ads Payment on Hold

If users are unable to pay for Facebook Ads, it might be because the payment method has been temporarily suspended for security reasons, resulting in a Facebook Ads Payment on Hold. This can occur due to unusual activity, unpaid previous bills, or suspected card theft.

For instance, if you are using a domestic bank card and a family member abroad uses it for payments, it can be flagged as unusual activity. This type of situation is quite common and results in Facebook Ads Payment on Hold until the issue is resolved.

To resolve Facebook Ads Payment on Hold, contact your card-issuing bank for advice and support. Additionally, add a new payment method and try the payment again.

>>> Read more: 5 Reasons Why Facebook Payment on Hold and How to Fix It

#5 Entering Incorrect Credit Card or Bank Account Information

Minor mistakes like entering incorrect card numbers, expiration dates, or CVV codes can cause payment rejections. Likewise, mistakes in bank account details, such as incorrect account numbers or mismatched account owner names, can disrupt the payment process.

To reduce the risk of these errors, double-check all information before completing transactions, and contact your bank or payment provider if you suspect any inaccuracies.

#6 Credit Card Limit Reached

Credit card limits set by your bank or card provider are a common reason for a Facebook Ads payment failed. These limits can be daily, weekly, or monthly and are often stricter for international transactions or specific categories like online payments. If your transactions hit these limits, further payments may be declined automatically as a security measure to prevent fraud or unauthorized spending.

If you face a Facebook Ads payment failed due to exceeding your card’s limit, consider contacting your bank or card provider to request a temporary limit increase or to discuss alternative solutions.

#7 Security Issues and Suspicious Activities

Banks and credit card providers use sophisticated monitoring systems to detect unusual or suspicious transaction patterns. If your transaction activity suddenly surges or takes place in an unfamiliar location, these security systems may flag it as a potential risk and reject the transaction.

While this measure protects cardholders from fraud, it can be inconvenient when legitimate transactions are declined. If you encounter this issue, contact your bank or card provider promptly to inform them of your intended transaction activity, especially if you plan to make larger-than-usual payments.

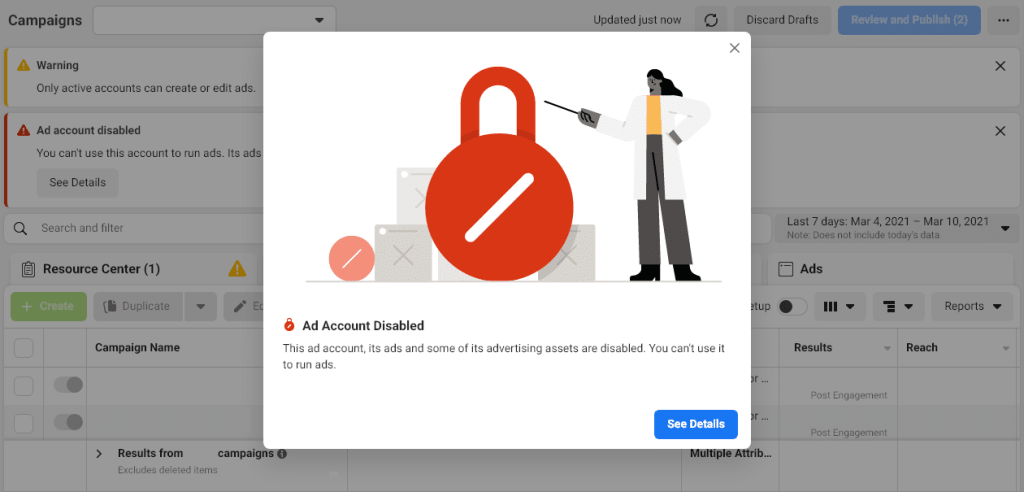

#8 Ad Account Suspension

If an ad account violates Facebook’s advertising policies or terms of service, it may be suspended. Any payment attempts during a suspension will fail. To resolve this, review Facebook’s policies, address any violations, and appeal the suspension.

#9 Technical Glitches

Technical issues can occasionally cause payment failures on Facebook Ads, even when your payment method and account are in good standing. If you face persistent payment failures, contact Facebook’s support team for assistance.

What to Do if your Facebook Ad Payment Failed?

While rejected payments can be frustrating, knowing the necessary steps can help prevent disruptions in your marketing efforts. In this section, we will explore practical and effective methods to address Facebook Ads payment rejections, offering guidance to resolve the issue and keep your marketing on track.

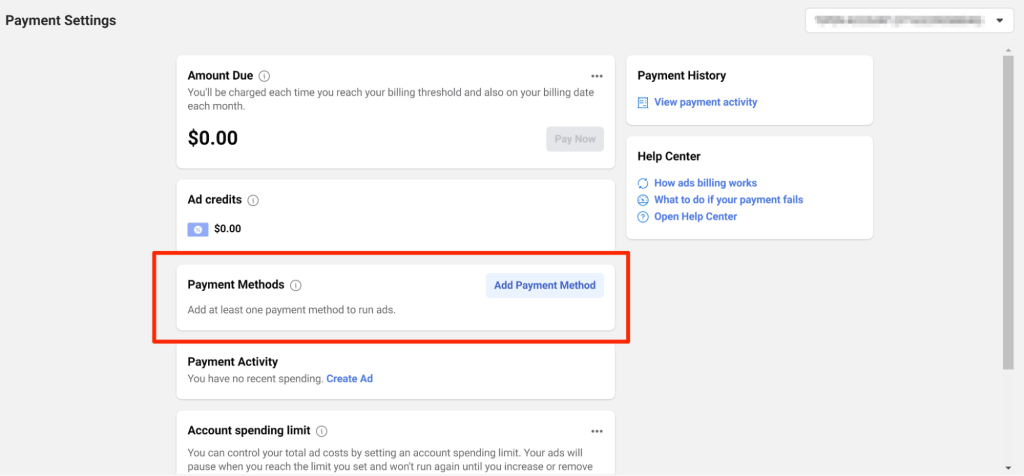

1. Update Your Payment Method

Ensure your payment methods—debit card, credit card, or ad credits—are valid and current. It’s possible your card has expired or reached its credit limit.

Simply update your payment method in the “Billing” section of your Facebook Ads Manager.

1. Verify Payment Information

The first crucial step to overcoming Facebook Ads payment rejections is to verify the accuracy of the credit card or bank account information you provide. Carefully check card numbers, expiration dates, security codes, and billing addresses. Even small errors can result in transaction rejection.

2. Contact Payment Service Providers

If Facebook Ads payment rejections continue after verifying your payment information, the next step is to contact your payment service provider. Rejections may occur due to limitations or technical issues with the payment platform. By reaching out to customer service, you can understand the reasons for the rejections and find appropriate solutions. Customer service can verify your account information and guide you through the necessary steps to resolve the issues.

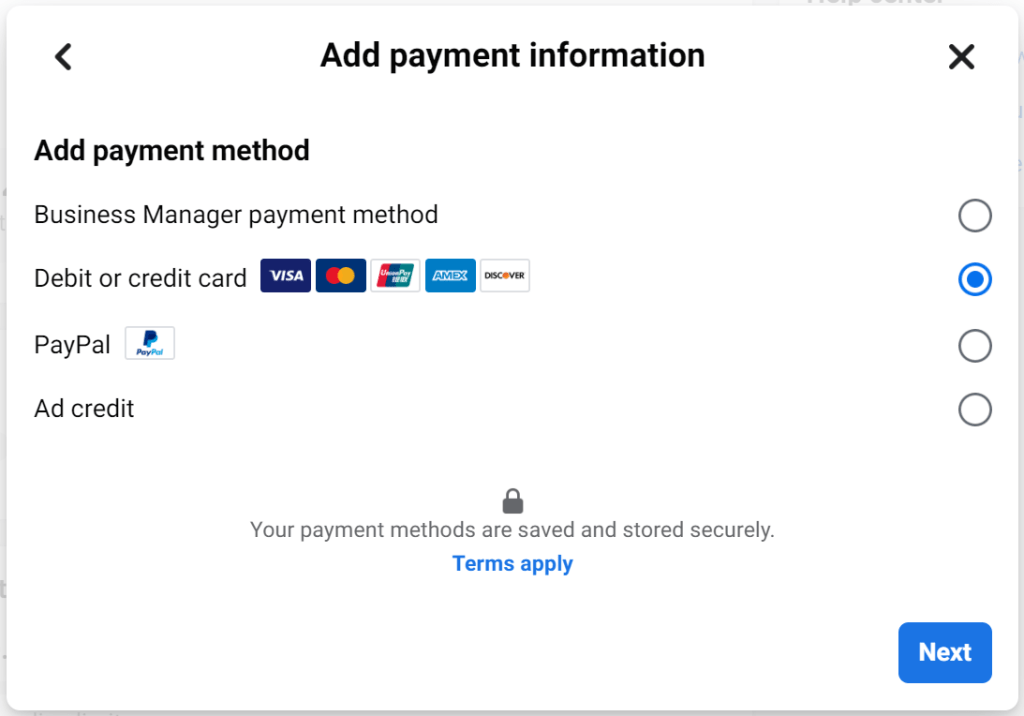

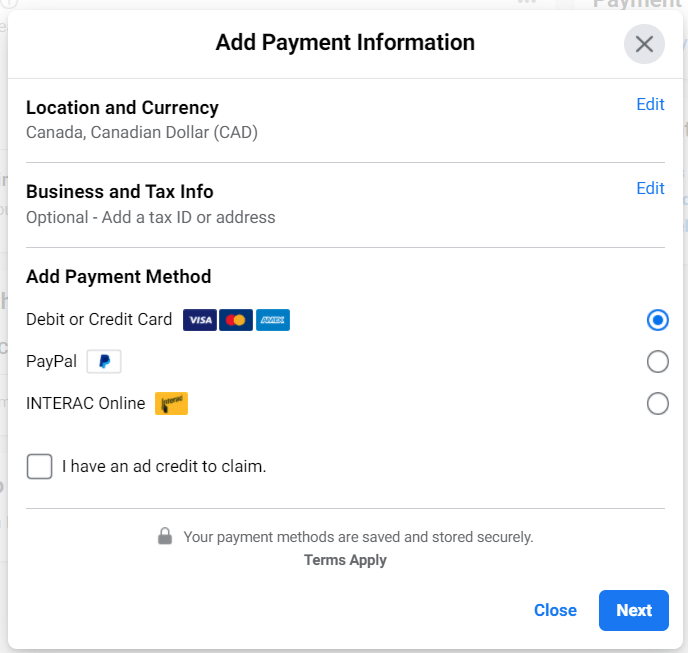

3. Use Different Payment Methods

To avoid payment rejection on Facebook Ads, consider using alternative payment methods. Besides credit cards, you can use debit cards, PayPal, or digital payment options like e-wallets. Ensure the chosen method is supported by Facebook Ads and meets your preferences and needs. By using various payment options, you can maintain flexibility and avoid payment issues in your marketing campaigns.

4. Use Prepaid or Virtual Debit Cards

Prepaid or virtual debit cards provide a controlled payment method that can be topped up before use, giving you full control over your marketing budget. The key advantage is that these cards are not linked to your primary bank account, reducing security risks. By allocating specific funds to your Facebook Ads, you can avoid problems related to spending limits or shortages that might occur with regular credit cards.

>>> Read more: How to Create a Facebook Prepaid Ad Account? Prepaid vs Postpaid?

Tips to Avoid Facebook Ad Payment Failures by Two Owls

Although making payments for your Facebook ads is usually straightforward, you can prevent future payment failures by trying the following methods:

1. Maintain Sufficient Funds in Your Account

Ensure your account has enough funds to cover each transaction, whether you use automatic or manual payments. The most common reason for Facebook ads payment issues is insufficient funds. Verify your account balance before starting the transaction or transfer funds from another account if necessary.

Facebook may charge your account in 2 scenarios:

- When you reach your payment threshold

- When you reach your monthly billing date and there are any leftover costs

To avoid these issues, it’s advisable to have a backup payment method for your Facebook ad account.

2. Verify Your Payment Method

Depending on your country, some payment methods may not work. Although Facebook accepts payments through most major gateways, it’s wise to confirm whether your payment method is supported. Facebook primarily accepts credit cards, PayPal, net banking, and debit cards.

Before making a payment, check the following:

- Your account information, including the CVV code and card number

- Whether your account permits online payments

- If you need to activate a specific service at your bank to process the payment

3. Limit the Number of Ad Accounts

By default, you can manage up to 25 ad accounts under your Facebook account. Exceeding this limit can prevent you from making payments.

If you’re a Facebook advertising consultant or manage multiple client accounts, create individual accounts for each ad account and grant your main account general access to them.

This approach is crucial for smooth ad operations and efficient ad account management.

4. Disconnect from VPNs and Remote Connections

Payment issues may arise if you’re connected to remote connections or foreign servers. Facebook has different payment methods for various countries, so ensure your payment method aligns with what Facebook allows in your region.

Using a VPN or connecting to a foreign server can mask your connection, preventing successful payments. To avoid this, connect to your local internet until your payments are completed.

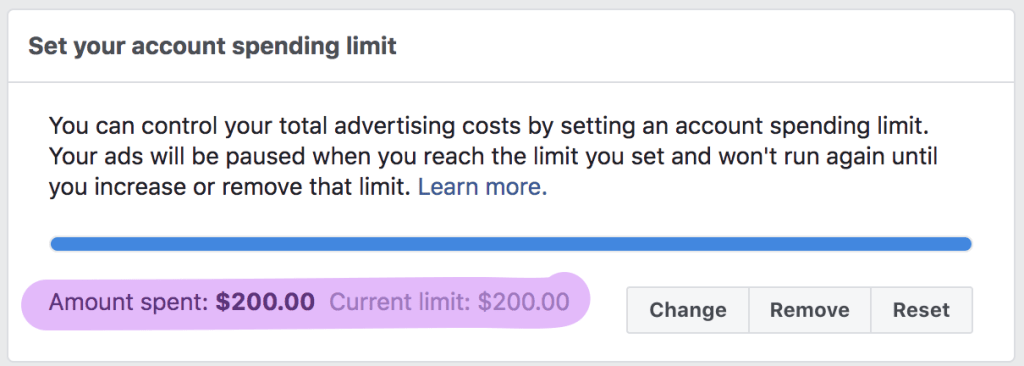

5. Verify Your Facebook Ads Manager Spending Limit

A spending limit on your Facebook ads manager means your ads will stop running once they hit the budget you’ve set.

To continue running ads, you’ll need to either increase or remove this spending limit. While you can add funds to your account, ads won’t resume until the limit is adjusted.

To check your spending limit:

- Go to the payment settings of your ad account.

- Find the Spending Limit section and click Set Limit.

- Enter or increase the spending limit.

- Click Save.

Wrap up

In summary, Facebook Ads payment failed issues can occur for various reasons. To ensure a smooth advertising experience, it’s important to identify and address these issues proactively. To reduce the risk of payment failures, verify your payment method, maintain sufficient funds, keep your payment information up to date, and adhere to Facebook’s policies. If issues continue, contact Facebook’s support team for help to resolve the problem and get your ad campaigns back on track.