How to Create a Facebook Prepaid Ad Account? Prepaid vs Postpaid?

Have you been trying different methods to set up a Facebook Prepaid Ad Account but still can’t seem to get it right? It can be tricky navigating the setup without clear guidance.

So, this detailed guide is here to assist you through the steps of creating your prepaid account, as well as managing your Facebook ads prepaid funds.

Let’s go!

What is Facebook Prepaid Ad Account?

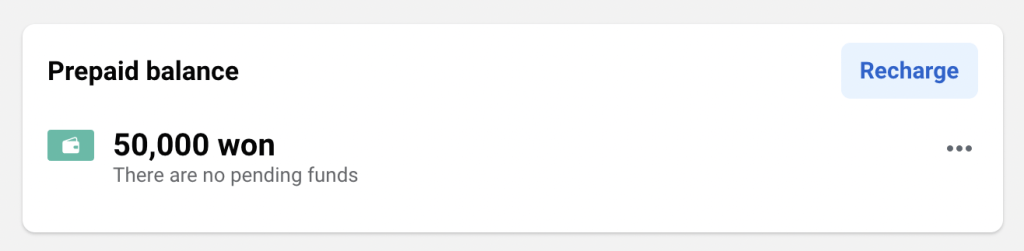

A Facebook Prepaid Ad Account (also known as manual ad account) is a type of advertising account where you pay for your ads before they run. This means you add money to your account, and Facebook deducts from this balance as your ads accrue costs. It operates similarly to a prepaid mobile phone plan, where you pay in advance for the services you use.

Benefits of Using a Prepaid Ad Account?

Using a Facebook prepaid ad account offers several benefits:

1. Budget Control

- Fixed Spending: With a prepaid account, you can only spend the amount you’ve loaded onto your account. This prevents overspending and helps maintain a strict budget.

- Better Planning: It allows for precise budgeting and planning, ensuring you don’t exceed your advertising budget.

2. No Surprise Bills

- Avoid Unexpected Charges: Since you prepay for your ads, there are no unexpected charges or bills. You know exactly how much you’re spending upfront.

- Transparent Costs: The costs are clear and transparent, with no risk of accumulating a large bill at the end of the month.

3. Flexibility

- Control Over Ad Spend: Advertisers can control their ad spend more effectively, stopping campaigns when the prepaid balance runs out.

- Short-Term Campaigns: Ideal for short-term campaigns or businesses that run intermittent advertising, as there’s no ongoing commitment.

4. Suitable for Small Businesses

- Lower Financial Risk: Small businesses or those new to advertising can start with a smaller budget without the risk of incurring high costs.

- Ease of Entry: It provides an easy entry point for businesses to test and optimize their ad strategies before committing to larger budgets.

Prepaid vs. Postpaid: Which is Better?

Choosing between a prepaid and postpaid Facebook ad account depends on your specific needs and circumstances. Here’s a comparison to help you decide which is better for you:

| Feature | Facebook Prepaid Ad Account | Facebook Postpaid Ad Account |

|---|---|---|

| Budget Control | High control; only spend what you’ve prepaid | Requires monitoring to avoid overspending |

| Payment Method | Prepay using various methods (bank transfer, etc.) | Billed automatically to a credit card or similar method |

| Billing Cycle | Pay upfront before ads run | Billed periodically after ads run |

| Convenience | Requires manual top-ups | Automatic billing; more convenient |

| Spending Limit | Limited to prepaid amount | Higher spending limits without frequent interruptions |

| Risk of Overspending | No risk, as you can only spend prepaid amount | Risk of overspending if not monitored closely |

| Interruptions | Ads stop if balance runs out | Ads run continuously without interruption |

| Ideal For | Small businesses, freelancers, new advertisers, regions with low credit card usage | Larger businesses, agencies, frequent advertisers |

| Accessibility | Suitable for areas with limited credit card use | Requires access to credit cards or similar payment methods |

| Flexibility | Requires frequent monitoring and manual intervention | Allows for easier cash flow management with periodic billing |

| Predictability | High; no surprise bills | Lower; requires monitoring to avoid surprises |

| Spending Alerts | Can set up alerts for low balance | No alerts; relies on periodic billing cycle |

Which is better? It depends on your needs:

Prepaid Accounts are better for those who want strict control over their budget, are new to Facebook advertising, or operate in regions where credit cards are less common. They are also ideal for small businesses, startups, freelancers, and individual advertisers who prefer to avoid surprise bills and manage their spending closely.

Postpaid Accounts are more suitable for larger businesses or agencies with higher ad budgets and frequent campaigns. They offer the convenience of continuous ad running without manual interventions and are better for those who can manage periodic billing cycles and have access to credit cards or similar payment methods.

How to Create a Prepaid Ad Account on Facebook?

1. Begin by setting up a Meta advertisement.

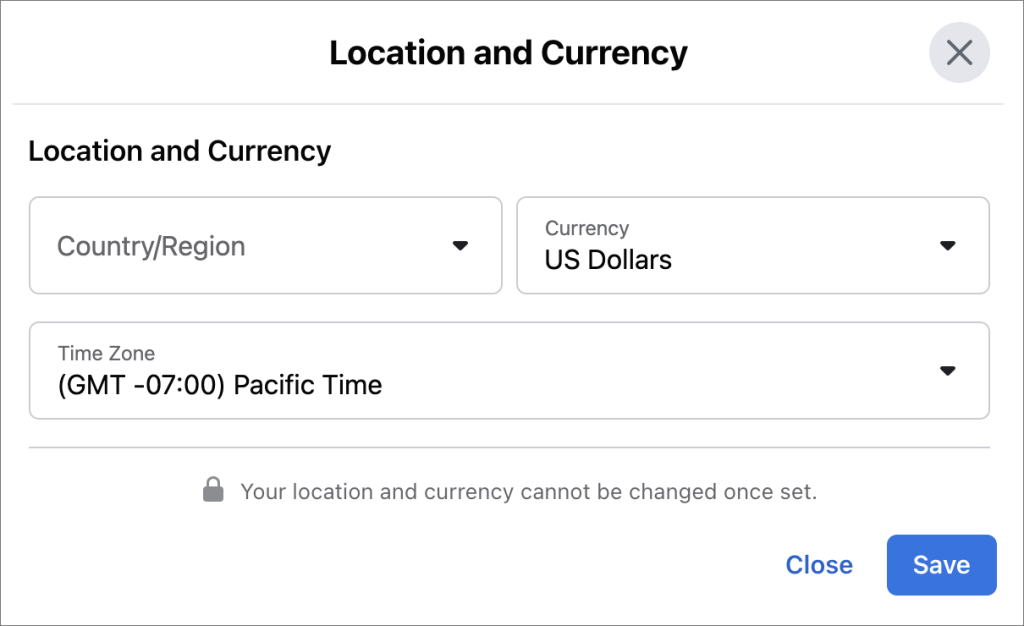

2. Ensure the account country and currency align with the accepted payment methods during the setup process.

3. After confirming your ad purchase, choose the prepaid fund method and click “Continue”.

4. Review the confirmation screen and proceed by clicking “Continue”.

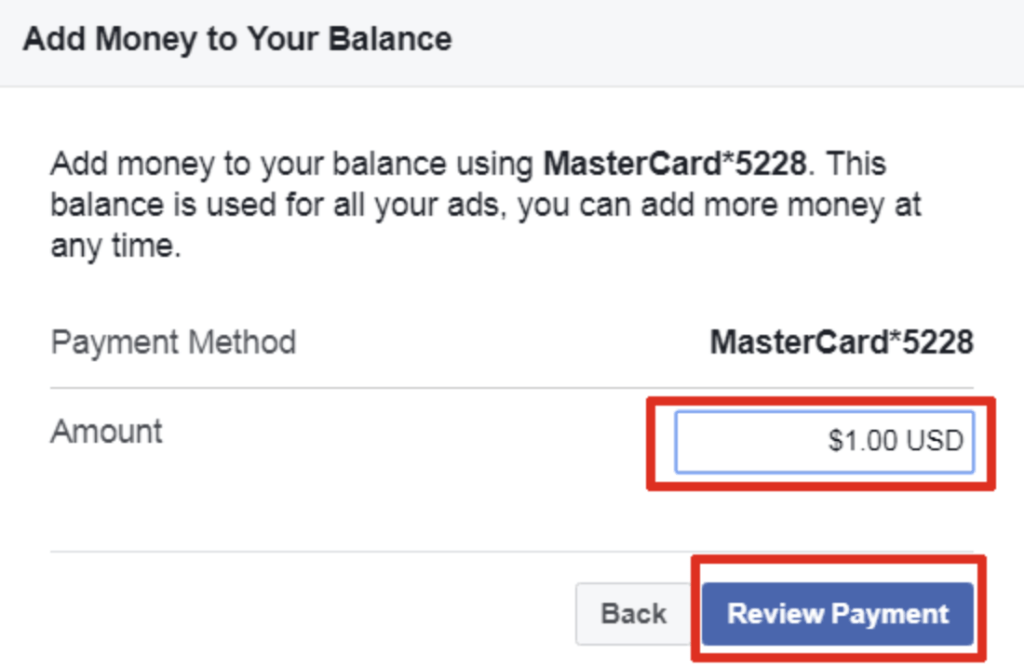

5. Input your business information and specify a payment amount within the allowed limit, then click “Review payment”.

6. Follow the provided instructions to add funds to your ad account. These steps may vary based on the chosen payment method.

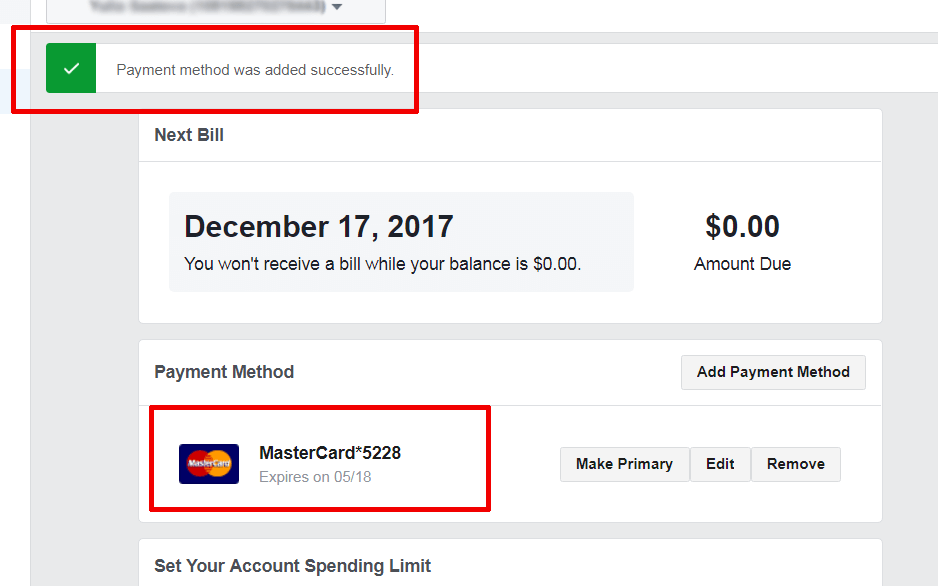

Your ad account will now be configured for prepaid funds. Depending on the payment method, your balance will update either immediately or once the payment is complete.

Note: If adding a prepaid fund method is unsuccessful, ensure that:

- The selected prepaid fund method is accepted.

- The country and currency of the ad account match those of the payment method.

For more details, you can learn more here.

How to Change from Prepaid to Postpaid in Facebook Ads?

Switching from a prepaid to a postpaid billing method in Facebook Ads involves a few steps. Here's how you can do it:

- Navigate to your payment settings within Ads Manager.

- Under the Payment methods section, select the 3 dots (…) next to your existing payment method on the right.

- Choose the Edit option from the dropdown menu.

- Make the necessary changes and click on Save.

Your payment method has now been successfully updated.

Expert Tips from Two Owls - Omega Pixels:

- Keep an eye on your billing statements to ensure that your ads are being charged correctly.

- Ensure you have sufficient funds in your payment method to avoid any interruptions in your ad campaigns.

Facebook Prepaid Ad Account FAQs

To help you better understand and manage your account, I’ve compiled a list of the most frequently asked questions and their detailed answers below

How to Set up an Account Spending Limit?

If you want to set up an account spending limit for a Facebook prepaid ad account, follow these steps:

- Go to Ads Manager: Log in to your Facebook Ads Manager.

- Billing Section: Click on the menu in the top left corner and select “Billing & Payment Methods”.

- Set Account Spending Limit: Click on the “Payment Settings” link and then click on the “Set Account Spending Limit” button.

- Enter Limit: Input the desired spending limit for your account and click “Set Limit”.

This helps you control your overall spending and ensures you stay within your budget.

How Do I Remove Prepaid Funds on Facebook?

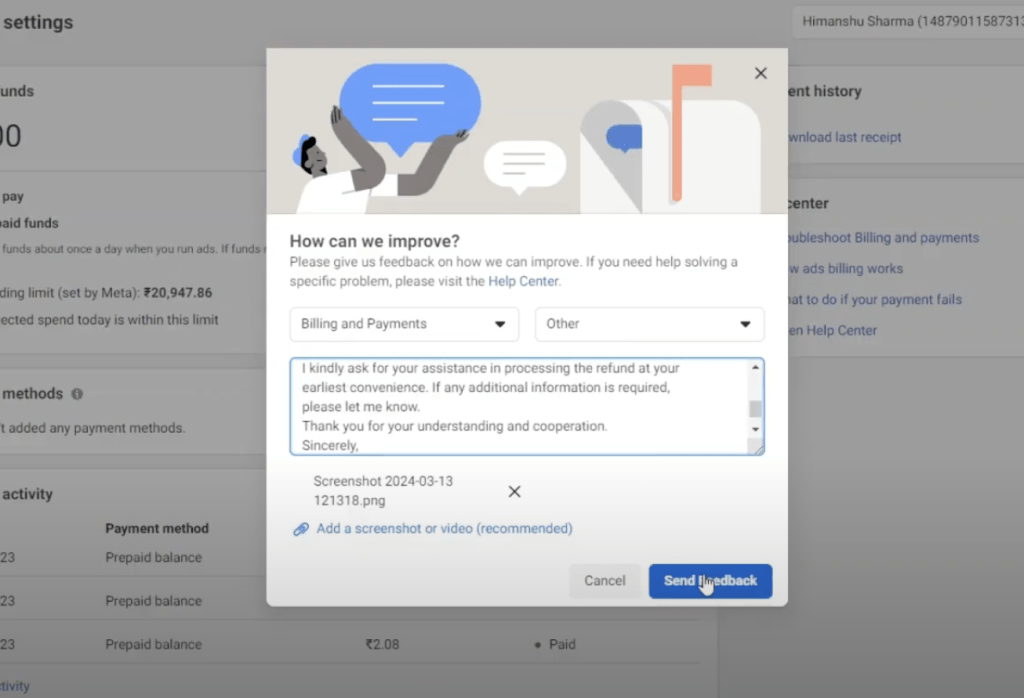

If there are remaining prepaid funds, contact Facebook support to request a refund. Facebook doesn’t provide a direct option to remove prepaid funds manually.

- Log in to Ads Manager: Access your Facebook Ads Manager.

- Go to Billing & Payment Methods: Navigate to the billing section.

- Request a Refund: If there are remaining prepaid funds, contact Facebook support to request a refund.

How Long Do Refunds Take?

Refund processing times can vary based on your payment provider and their policies. Generally, it takes about 7-10 business days for Facebook to process the refund. After Facebook processes the refund, it may take additional time for your payment provider to credit the funds back to your account. It’s advisable to check with your payment provider for their specific refund processing times.

Are there any fees for adding funds to my Facebook ad prepaid account?

Facebook does not charge fees for adding funds to your prepaid account. However, your payment provider, such as your bank or credit card company, may impose their own transaction fees or service charges. It’s advisable to check with your payment provider to understand any additional costs that might apply when adding funds to your Facebook prepaid ad account.

What should I do if my Facebook prepaid ad account payment is on hold?

If your Facebook prepaid ad account payment is on hold, it’s essential to check the reason for the hold first. This could be due to an issue with the payment method, a billing threshold not being met, or a review by Facebook’s team. To resolve this, update your payment method, ensure your billing information is accurate, and follow any instructions provided by Facebook. If the issue persists, contact Facebook Support for further assistance.

Learn More: 5 Reasons Why Facebook Payment on Hold and How to Fix It

Wrap up

I hope this article has provided you with a clear understanding of how Facebook Prepaid Ad Accounts can benefit a variety of users, particularly those who prioritize strict budget control in their advertising strategies.

By preloading funds, users ensure that their spending does not exceed planned amounts, which is especially beneficial for those who need to manage financial resources carefully. It offers a practical approach to financial management in advertising, making it a wise choice for proactive advertisers looking for predictability and control.

Deduplication in Facebook Pixel: How to Fix Duplicate Events and Track Data Correctly

Omega TikTok Pixels Now Speaks Your Language: Introducing Multi-Language Support

Trakpilot New Feature: Export Your Conversion Events Data